The Best Online Tax Return Services Available in Australia Right Now

The Best Online Tax Return Services Available in Australia Right Now

Blog Article

Comprehending the Importance of a Tax Return: Just How It Affects Your Economic Future

Understanding the importance of an income tax return prolongs past mere compliance; it acts as an essential tool fit your financial trajectory. A detailed tax return can affect vital decisions, such as finance qualification and prospective savings through credit histories and reductions. On top of that, it uses insights that can tactically notify your investment options. However, lots of individuals take too lightly the implications of their tax filings, frequently overlooking the wealth-building opportunities they provide. This raises crucial questions about the wider effect of tax returns on lasting monetary stability and planning. What might you be missing out on?

Introduction of Tax Returns

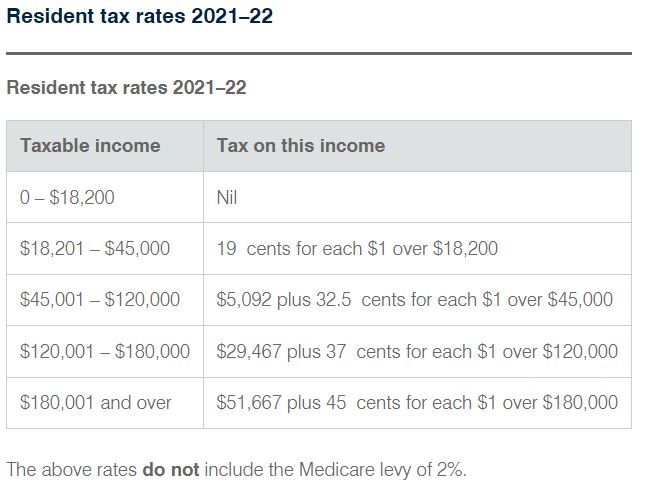

Tax returns are important papers that people and organizations file with tax authorities to report earnings, expenditures, and other monetary info for a particular tax obligation year. These substantial types serve numerous objectives, consisting of identifying tax obligation liabilities, declaring deductions, and evaluating qualification for numerous tax obligation credits. The main components of a Tax return generally include revenue from all resources, modifications to income, and a thorough malfunction of reductions and credit scores that can minimize general taxed earnings.

For people, common kinds consist of the internal revenue service Kind 1040 in the United States, which outlines wages, interest, dividends, and other types of earnings. Businesses, on the various other hand, might utilize the internal revenue service Kind 1120 or 1065, depending on their structure, to report company earnings and expenses.

Submitting income tax return precisely and prompt is crucial, as it not only assures conformity with tax obligation laws but additionally impacts future monetary preparation. A well-prepared income tax return can give understandings right into monetary health and wellness, highlight areas for possible savings, and help with educated decision-making for both companies and individuals. The intricacies entailed necessitate a complete understanding of the tax code, making expert guidance typically helpful.

Influence On Financing Eligibility

Prompt and accurate submission of tax obligation returns plays a necessary duty in figuring out an individual's or business's qualification for financings. Lenders usually require current tax obligation returns as component of their evaluation procedure, as they give a detailed review of income, monetary security, and overall economic wellness. This documentation helps lenders determine the consumer's ability to settle the finance.

For individuals, consistent income reported on income tax return can improve creditworthiness, causing a lot more beneficial funding terms. Lenders commonly try to find a stable revenue background, as rising and fall profits can increase concerns concerning repayment ability. For businesses, tax returns offer as a substantial indicator of earnings and money circulation, which are important variables in protecting company lendings.

Furthermore, inconsistencies or inaccuracies in income tax return might elevate warnings for loan providers, possibly leading to financing rejection. Therefore, maintaining precise records and filing returns on time is essential for companies and people aiming to enhance their car loan qualification. Finally, a well-prepared tax return is not just a lawful demand but additionally a calculated tool in leveraging monetary opportunities, making it basic for any individual thinking about a lending.

Tax Credit Histories and Deductions

Comprehending the subtleties of tax credit scores and deductions is important for optimizing financial results. Tax obligation credit scores directly minimize the quantity of tax obligation owed, while deductions lower taxable earnings. This difference is significant; for instance, a $1,000 tax credit decreases your tax obligation expense by $1,000, whereas a $1,000 reduction decreases your gross income by that quantity, which leads to a smaller sized tax reduction depending upon your tax bracket.

Reductions, on the other hand, can be detailed or taken as a standard deduction. Making a list of allows taxpayers to listing eligible expenses such as home loan passion and medical expenses, whereas the basic reduction provides a fixed reduction amount based upon filing condition.

Preparation for Future Investments

Efficient preparation for future financial investments is vital for constructing wide range and attaining financial objectives. A well-structured financial investment strategy can help individuals take advantage of possible development possibilities while additionally mitigating risks related to market changes. Comprehending your tax return is a necessary part of this preparation procedure, as it supplies understanding right into your economic wellness and tax obligation commitments.

In addition, being conscious of just how financial investments may influence your tax scenario enables you to pick investment lorries that line up with your overall financial method. For instance, focusing on tax-efficient financial investments, such as long-term funding gains or community bonds, can boost your after-tax returns (Online tax return).

Usual Tax Return Myths

Several individuals hold misunderstandings regarding income tax return that can bring about confusion and expensive blunders. One prevalent myth is that submitting an income tax return is only needed for those with a considerable earnings. In fact, even people with lower incomes might be called for to submit, specifically if they get approved for particular credit scores or have self-employment earnings.

Another common myth is the idea that obtaining a reimbursement indicates no tax obligations are owed. While reimbursements suggest overpayment, they do not absolve one from visit homepage obligation if taxes are due - Online tax return. In addition, some think that income tax return are only important throughout tax obligation season; however, they play a vital duty in economic planning throughout the year, impacting credit report and finance eligibility

Several likewise assume that if they can not pay their tax expense, they must stay clear of filing entirely. While practical, it is important for taxpayers to understand their special tax scenario and news review access to confirm conformity.

Resolving these misconceptions is necessary for effective financial administration and staying clear of unnecessary issues.

Verdict

To sum up, tax obligation returns offer as a fundamental component of monetary administration, influencing lending eligibility, discovering prospective cost savings with credit scores and deductions, and informing tactical investment choices. Disregarding the importance of exact tax obligation return filing can result in missed out on monetary opportunities and impede reliable monetary planning.

Tax obligation returns are crucial files that companies and people file with tax obligation authorities to report income, expenditures, and other monetary information for a details tax year.Submitting tax returns precisely and prompt is important, as it not just guarantees conformity with tax obligation laws yet also affects future economic planning. Nonrefundable credit ratings can only lower your tax obligation to absolutely official site no, while refundable credit reports might result in a Tax reimbursement exceeding your tax obligation owed. Usual tax obligation credit reports consist of the Earned Income Tax Credit Report and the Youngster Tax Credit score, both intended at sustaining family members and individuals.

Additionally, some think that tax obligation returns are just important throughout tax obligation period; nonetheless, they play an essential duty in monetary planning throughout the year, impacting debt scores and funding eligibility.

Report this page